ASML Holding (NASDAQ: ASML) is extending gains on Monday after a senior Bank of America analyst said it could be a major beneficiary of the recent $5.0 billion agreement between Intel and Nvidia.

The aforementioned deal is broadly expected to strengthen Intel’s competitiveness in data centres and PCs.

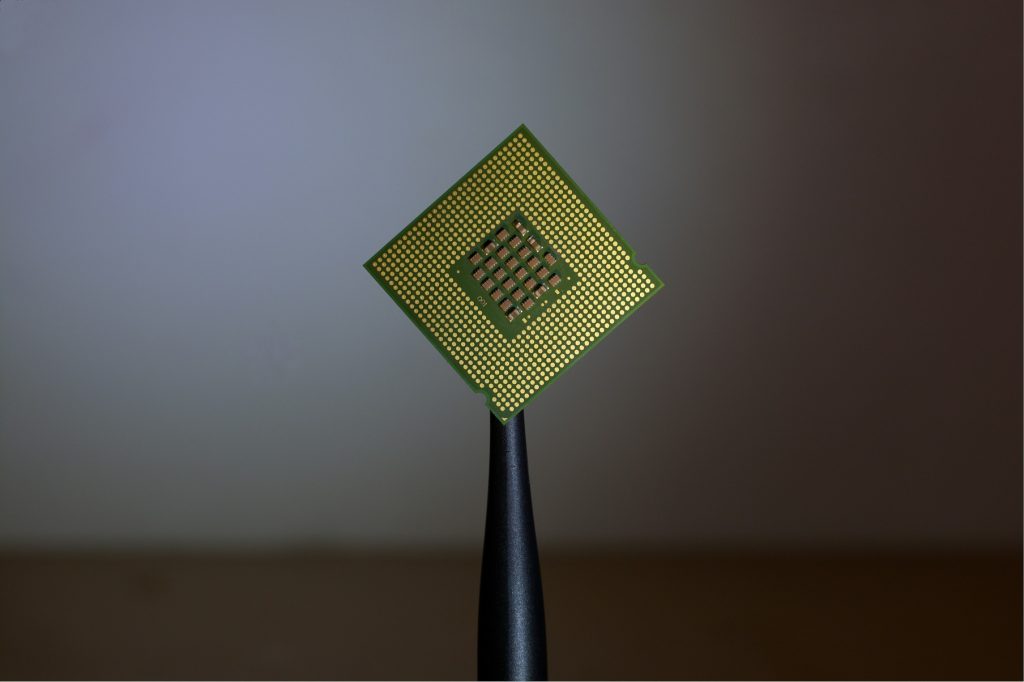

That, in turn, could drive demand for semiconductor manufacturing equipment – ASML’s core business.

BofA’s bullish call on ASML stock is particularly significant because it has already been in a sharp uptrend over the past five months.

At the time of writing, it’s up over 60% versus its year-to-date low in April.

Intel-Nvidia deal could unlock new demand for ASML stock

Intel-Nvidia collaboration is more than a strategic handshake – it could actually prove a potential catalyst for ASML’s growth.

By embedding Intel’s processors into Nvidia’s AI systems and vice versa, the deal positions Intel to regain ground in high-performance computing.

That resurgence could translate into increased capital spending on semiconductor fabrication – including purchases of ASML’s advanced lithography tools.

Bank of America analyst Didier Scemama noted, “a potentially more competitive Intel in both datacenters and PCs should be positive for semicaps,” which include ASML shares.

While the Intel-Nvidia transaction doesn’t include a foundry partnership, it injects fresh momentum into INTC’s roadmap – one that could lean heavily on ASML’s equipment to meet rising chip demand.

While the agreement stops short of a full foundry partnership, it injects fresh momentum into Intel’s roadmap—one that could lean heavily on ASML equipment to meet rising chip complexity.

ASML shares to benefit from lithography equipment demand

ASML’s core business – lithography systems used in chip production – is already seeing a massive surge in demand this year.

As semiconductor firms race to build more powerful and efficient chips, the need for cutting-edge photolithography tools has intensified.

ASML, which currently dominates the market for extreme ultraviolet (EUV) machines, stands to benefit from this trend.

Moreover, Intel will likely need to invest rather heavily in its manufacturing capabilities after the NVDA investment, which could further boost demand for ASML’s offerings as INTC relies on its lithography machines to produce the most sophisticated chips.

BofA analyst Didier Scemama also highlighted the uptick in equipment orders as a key reason for its bullish stance.

In short, with chipmakers ramping up production to meet AI and cloud computing needs, the Dutch company’s specialised machinery is becoming indispensable, which could unlock further upside in ASML shares.

What else could benefit ASML stock moving forward?

Beyond the Intel-Nvidia deal, ASML stock’s long-term prospects are bolstered by the expected launch of multiple chipmaking facilities across the US.

Intel, Samsung, and TSMC are all planning new fabs, which could significantly boost demand for ASML’s equipment.

According to Scemama, “Investors are likely to focus on 2027, which should see a substantial revenue acceleration… owing to the opening of several new fabs in the US.”

These facilities will require advanced lithography systems to produce next-generation chips, positioning ASML as a key supplier.

With geopolitical tailwinds favouring domestic semiconductor production, ASML’s shares’ exposure to these projects could drive meaningful revenue growth over the next few years.

The post ASML stock: how it may benefit from Intel-Nvidia deal appeared first on Invezz